Are hefty service charges and exchange rates eating up your finances?

If they are, then it’s time you find cost-effective ways to send your international payments.

Traditional money transfer methods often cost you more than the amount you transmit because of their hefty fees.

Thankfully, new methods have emerged to make your money transfers more affordable and transparent — while providing as much convenience and security as traditional means.

Continue reading to learn how your b2b company can send international payments while avoiding excessive fees.

1. Use online-based money transfer tools.

Online money transfer tools offer cheaper rates for your online B2B payments services.

These specialized companies charge zero to low fees only and use much lower currency exchange rates than bank offers.

They can do that because they reduce their running expenses and profit mostly from the volume of transmitted funds.

These tools process money transfers of all sizes, guarantee tight security, and offer hedging instruments.

Here are two cost-effective tools you can use for your business:

a. TransferWise

TransferWise specializes in small money transfers. It charges an upfront fee between 0.5 and 2 percent, depending on the route.

It bases its system on local bank account transfers, making its fees eight times cheaper on average than the top UK high street banks.

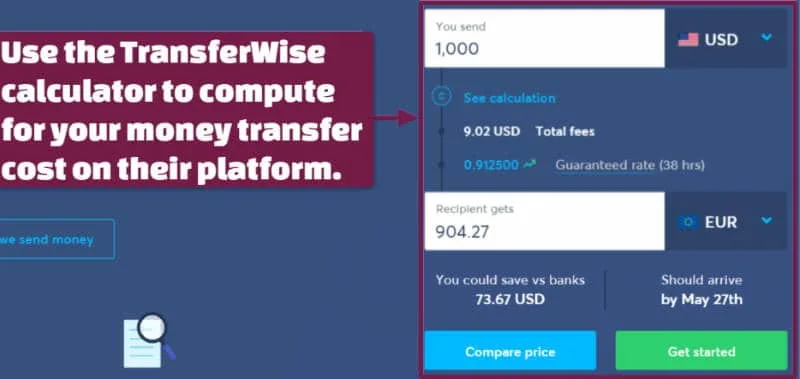

TransferWise uses real exchange rates, has fixed margins, and displays its fees transparently.

It has a calculator on its site so you can compute your money transfer costs. It also has a mobile app through which you can send money, make debit or credit card payments, and more.

b. OFX

OFX is an industry veteran that focuses more on large money transfers, making it ideal for online sellers and small and medium businesses.

With its low margins and fees, OFX lets you save up to 50 percent on your transaction as compared with bank transfers.

OFX cuts its currency fee as you send larger amounts, ranging from 1 percent for small transfers to 0.4 percent for bigger ones. Its minimum transfer amount is 500 dollars.

It has 24/7 support and a mobile app from which you can send payments, track your money transfer, and get live exchange rates with its currency converter.

2. Create a multi-currency account.

Multi-currency accounts let you hold several currencies in a single account via wire transfer, check, debit card, and automated clearing house (ACH).

These accounts allow you to supervise your international finances, including invoices and client payments.

Multi-currency accounts minimize costs because they offer low exchange rates and help process global money transfers more safely and quickly.

With this type of account, you can withdraw, send, and collect payments in local and international currencies without converting after each transaction.

Because of this reduced number of conversions, you get to spend on fewer forex and conversion charges.

You also save up on account maintenance expenses since you only pay for one account instead of separate ones.

In this way, you curtail your expenses while boosting the convenience of transacting in various currencies and moving finances between accounts.

3. Apply for hedging.

Hedging refers to strategies that mitigate the impact of unfavorable fluctuations in currency exchange rates and prices.

It curtails potential losses but prevents additional profit generation. Hedging is like purchasing insurance against risky movements at the expense of earnings from positive changes.

You can apply hedging when you’re investing in foreign currencies and processing international payments.

When investing, you can use a put option (right to sell an asset at a specific price in a predetermined future date) to hedge against deficits in a stock position. Gains in the option offset any loss in the stock.

Similarly, for overseas business transactions, you can define the exchange rate of a deal for a future date instead of using the prevailing rate on that period.

When that happens, you save the profit that can be earned. The amount remains steady despite exchange rate fluctuations between the contract date and payment period.

You can then minimize the possibility of loss until the payment is settled.

Common hedging strategies include signing futures and forward contracts. They both allow you to buy or sell an asset at a predetermined price and a specific period in the future.

Futures differ from forwards in that the latter isn’t standardized and signifies a private contract between parties instead of an exchange (as in the case of the former).

With hedging, you can save money on your overseas business transactions, minimize risks, and help you lock in on a favorable exchange rate.

Why Are Online-Based Money Transfer Tools Ideal for Your Small B2B Business?

Online-based money transfer tools are far more cost-effective than conventional means.

Banks, for instance, set high fixed service fees amid weak exchange rates.

One reason for that is they offer an array of financial services. They can’t provide the same extent of support as do dedicated money transfer companies or foreign exchange brokers.

These companies and brokers propose more favorable deals and rates because of their sizable volume of transactions.

Some retail banks charge more than 33 US dollars for their services and don’t display their exchange rates. Plus, they incorporate additional hidden fees of 5 to 7 percent.

Additionally, global wire transfer operators, such as Western Union and MoneyGram, often charge highly for delivering money fast.

The larger your transfer, the bigger the fees — costing up to five percent (or more) of the amount you’re sending.

While these wire operators offer deals and provide calculators to estimate your spending, they don’t necessarily use the mid-market exchange rate.

In contrast, innovative money transfer tools, such as those mentioned earlier, use real currency exchange rates and only require modest service fees.

These financial technology companies transparently show your transaction details and assure you of having no hidden fees.

Many tools don’t even have setup or monthly fees to keep your account active. Plus, since they’re online-based, you don’t need to complete any paperwork before transferring money.

You can transact conveniently, rapidly, and safely from their platform or app 24/7 — instead of running to your bank and wire operator on their office hours.

Conclusion

Sending international payments doesn’t have to be hassling and expensive.

These strategies and innovative online tools help you protect your finances and cut down on money transfer costs without compromising your security and convenience.

Do a little research online and compare the forex providers’ features to select the best one for your small B2B online business.

If you found this post helpful, spare a second to hit the “Like” button below. Cheers!