Warren Buffet’s Advice are simple. However, Warren Buffett is arguably the most successful investor of the 20th century (if not of all time).

Buffett began investing at the early age of 11, and by the time he was 13 he was already running a small business as a paperboy.

Fun fact: that same year, little Warren filed his first tax return, claiming his bike as a $35 tax deduction.

Warren Buffett was almost certainly born with business in his blood; however, his words of wisdom can benefit your financial life as well (regardless of your blood chemistry).

Although he is now in his mid 80s, Buffett has still yet to write a book. He definitely has enough knowledge for a small non-fiction series, though.

Regardless, his voice remains the most respected and trusted amongst both, investment professionals and the investing public.

That being said, let’s take a look at what financial knowledge the Oracle of Omaha is willing to share.

Saving his best investment advice for a little bit later, let’s first address Buffett’s more general financial tips for the average Joe.

Buffett strongly advises everyone to limit what they borrow. He claims that it’s simply not possible to become rich by living on borrowed money – which makes sense (to most people, at least).

I’ve seen more people fail because of liquor and leverage – leverage being borrowed money. You really don’t need leverage in this world much.

If you’re smart, you’re going to make a lot of money without borrowing.

Now that you are familiar with Buffett’s thoughts on loans, you need to start thinking of borrowing money as a ‘non option’.

If, however, there is no other choice and you absolutely need to borrow some money, you should do so with an objective assessment of future cash flow.

If you don’t have a solid plan to pay this debt off you will become a slave to the interest (perhaps even for life).

With Buffett being most recognized as an investor, let’s see what he has to say regarding stock.

In his 1989 letter to shareholders of Berkshire Hathaway, Warren Buffett claims that…

Warren Buffet’s advice: “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Clearly, buying a stock is about much more than just the price.

Finding a ‘wonderful’ company that you believe in, and ignoring gloomy economic and stock market forecasts may seem like risky business; and although it might be, it has worked for Buffett many times over.

Coca-Cola being a prime example of a (at least financially) wonderful company that Buffett was smart enough to invest in.

All this talk about “wonderful” companies raises some confusion.

What exactly is a wonderful company? Well, although it’s hard to quantify “wonderful”, Buffett has probably done it. According to the financial wiz – a “wonderful business” includes the following:

The business has to be understandable. You should be able to tell quite easily what the company is about.

There should also be a good return on the capital without much debt.

Cash flow should show profit, and the earnings are predictable.

Their franchises are strong, and they have the freedom to price the product as they see fit.

Warren Buffet’s advice: “the company shouldn’t take a genius to run, and the management must be owner-oriented.”

Pretty solid advice. It’s definitely a good idea to include at least one such ‘wonderful’ company in your portfolio. If you’re patient enough, a wonderful company should (according to Buffett) always be worth the investment.

When investing it’s important to first understand the investment pyramid, and then develop an investment strategy.

Consulting professional advisors regularly to review and diversify your investments is also a great idea.

Like Buffett famously said –

Risk comes from not knowing what you’re doing.

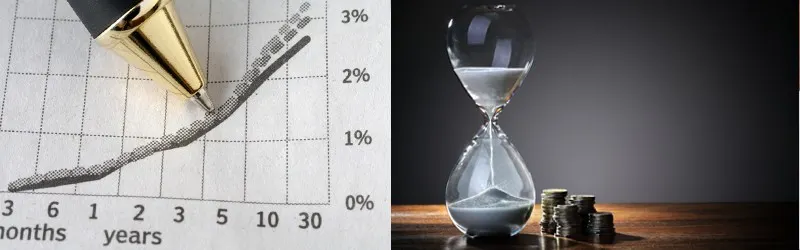

Since Warren Buffett himself holds a very disciplined investment style, it comes as no surprise that he is a strong promoter of patience in investing. Buffett claims that trying to get rich quick is a mistake, and that –

Warren Buffet’s advice: “It’s pretty easy to get well-to-do slowly. But it’s not easy to get rich quick.”

Pretty much all of Buffett’s advice can be summed up in a classic idiom – slow and steady wins the race.

Over the years, this idiom has become Buffett’s mantra, and this approach consistently outperformed the market for decades, making Warren a billionaire many times over.

Another great Buffett quote regarding long-term thinking can be found in the 1986 letter to the shareholders of Berkshire Hathaway. The quote reads:

No matter how great the talent or efforts, some things just take time. You can’t produce a baby in one month by getting nine women pregnant.

Now, that’s a good point. Buffett argues that money is part of nature, not something that can grow overnight.

Most people make the mistake of overestimating what they think they’ll make in a year, and underestimating the potential earnings of a decade.

Sticking to the Buffett Principle, you can make money without constantly changing portfolios, simply by staying invested for the long term.

Life is like a snowball. The important thing is finding wet snow (opportunities) and a really long hill (long term).

This Buffett classic connects quite well with the idea of waiting for your investments to pay off. Investing with long-term plans in mind can be stressful, but it’s important not to panic while seeing short-term fluctuations.

You only lose money when you sell, however, if you have the backbone to wait it out, you just might come out on top, after all –

Warren Buffet’s advice: “Over the long term, the stock market news will be good.”

I think it’s fair to say that Buffett is in the right here.

Over the last century the United States has endured two wars, a great depression, numerous recessions, oil shocks and the like, yet the Dow rose from 66 to 18,000. It’s probably safe to say that it’ll keep climbing in the long run.

So, like Warren Buffett once said:

… If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes. Put together a portfolio of companies whose aggregate earnings march upward over the years, and so also will the portfolio’s market value.

This connects back to the aforementioned idea of a ‘wonderful’ company. Invest in what you believe in, and wait it out. It might even be best to not check on your investments every day.

Getting a low evaluation might discourage you and force you to sell your stock at the worst possible time. Always look at the big picture.

To wrap it up – educate yourself, and know what you’re getting into.

Follow Buffett’s simple words of advice, and be patient with your investments.

After all, “it is not necessary to do extraordinary things to get extraordinary results.”